.01

Where Investment Outcomes Are Realized

At TBV, we’re in the trenches with you.

We’re invested in the success of every venture, not only for our own gain but for yours. This is the benefit of passion-driven projects conceptualized for impact and legacy-building. We are committed to finding those peak, trending opportunities and leveraging them into high-return projects you can get excited about.

.02

Past Ventures With Thoroughbred

With over 90 years of combined experience, we’ve worked across a wide spectrum of industries, from restaurants and commercial projects to crude oil extraction and healthcare. We know diversity is the key to longevity. Here is a glimpse of past and current investor projects.

Healthcare

New Waters Recovery – Filling the Treatment Gap in Raleigh‑Durham

Quick Facts

- The first integrative wellness center in NC to offer medical detox and clinical mental health assessment under one roof, and the first luxury treatment center serving high-net-worth families in the region.

- Positioned less than one mile from Duke Raleigh Hospital in the fast-growing Raleigh-Durham market, providing convenient access to North Carolina’s innovation corridor and affluent residential areas.

- Maintains highest industry standards with full accreditation and accepts most private insurance carriers, ensuring quality care and broad market accessibility.

- Thriving detox center generating strong returns through premium positioning; expanding with a residential treatment facility in Fuquay-Varina to capture the full continuum of care and maximize revenue from the existing client base.

Millions of Americans suffer from substance‑use disorder, yet only a fraction receive treatment due in large part to the lack of accessible care options. In North Carolina alone, overdose deaths have surpassed 30,000 over the past two decades.[1]

TBV Healthcare noted a critical gap in available addiction treatment options in North Carolina, with no stand-alone detox facilities in the state, and the only residential facilities in the Raleigh-Durham area catering to low-income families.

New Waters Recovery was established in 2022 as a standalone detox and mental health center catering to high-net-worth families and individuals, providing a luxury detox experience that previously did not exist in the state. We assembled an experienced addiction-care team and sited the facility close to Duke Raleigh Hospital and major transportation routes.

New Waters offers a high-touch experience with a low client‑to‑staff ratio. Clients undergo medical withdrawal management complemented by IV therapy, massage, acupuncture, yoga, sauna sessions, chef-prepared meals, and fitness programming. A seven to fourteen-day assessment delivers psychodiagnostic testing, psychiatric evaluation, and genetic analysis, and the center is both Joint Commission-accredited and insurance-friendly.

New Waters has quickly filled a significant market gap, delivering strong occupancy and cash flow. Its success has prompted TBV to develop a residential treatment center nearby to serve clients once they complete detox. For investors, partnering in New Waters means participation in a tangible, socially impactful asset that provides cash‑flow potential, asset appreciation, and favorable depreciation benefits.

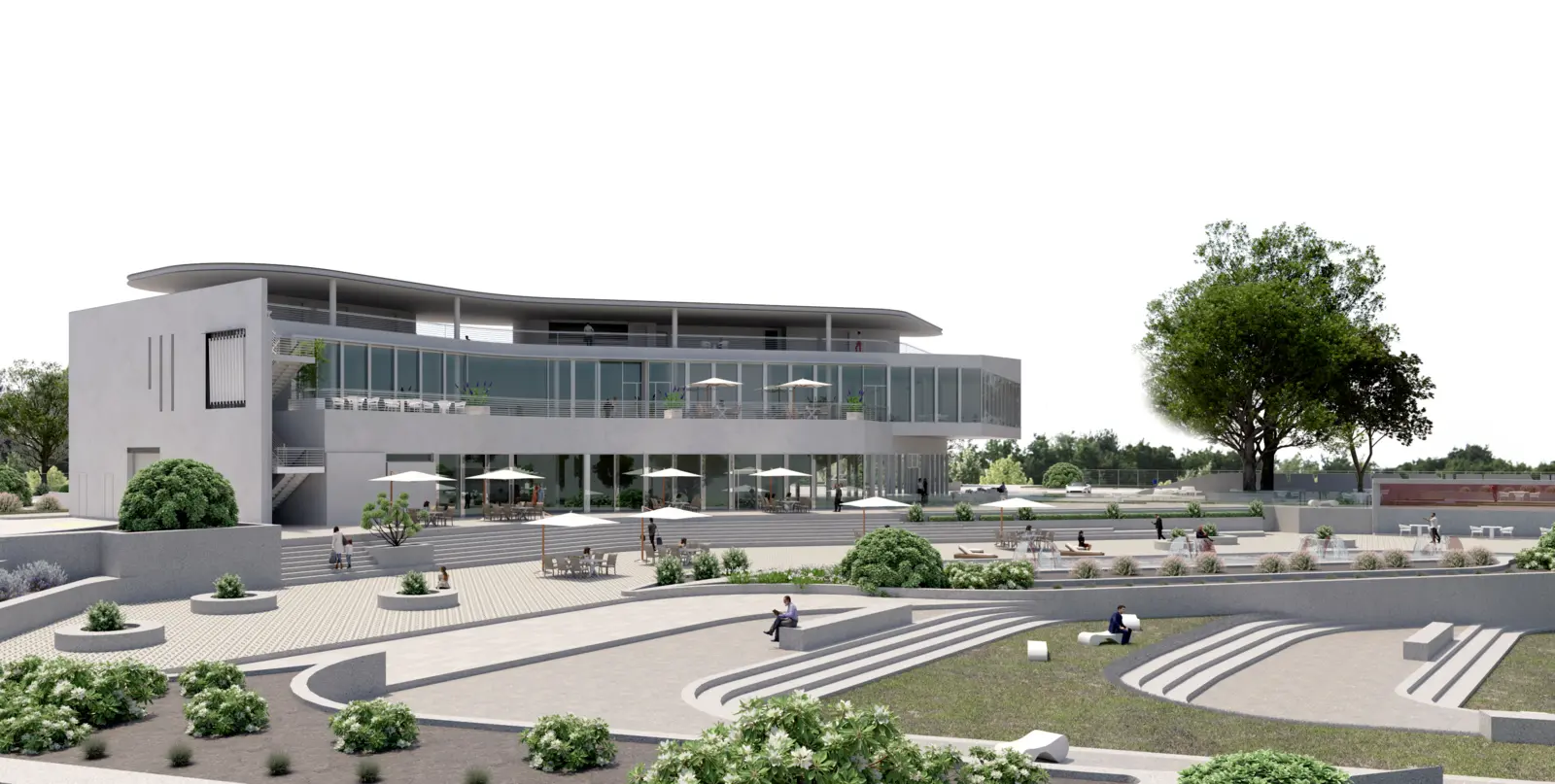

HOSPITALITY

5 Soul Food Co – Creating a Culinary Destination in Spicewood, Texas

Quick Facts

- Situated on a 7+ acre site along State Highway 71 in Spicewood, TX, 5 Soul Food Co. offers sweeping views of Lake Travis and the Texas Hill Country, an unmatched setting for dining, entertainment, and events.

- Located directly across the street from the successful 5 Soul Wine Co., the venue will benefit from an established customer base and consistent foot traffic from winery guests, pickleball players, and local events.

- Spicewood and the Lake Travis corridor are booming, with thousands of new homes and commercial projects underway, but the area still lacks diverse dining and nightlife options. 5 Soul Food Co. fills this gap with a first-to-market multi-kitchen food hall.

- Plans include 8–10 food hall kitchens, 2 full-service sit-down restaurants, multiple high-end bars, and a rooftop event space, offering guests new dining experiences daily and strong potential for recurring revenue.

- The project is managed by FireTen Hospitality, experienced operators of food halls and entertainment venues.

Spicewood and the surrounding Hill Country near Austin lack diverse dining and entertainment options, even as residential growth accelerates. Responding to this unmet demand, TBV has partnered with leading food‑hall operator FireTen to create 5 Soul Food Co., a hospitality project that allows accredited investors to own equity in a food-hall and entertainment destination.

The venue is being designed to include eight to ten independent kitchens serving different cuisines, encouraging patrons to visit repeatedly. It will also feature two full-service sit-down restaurants, multiple high-end bars, and a rooftop bar and event space offering panoramic views of the Texas Hill Country and Lake Travis. The design also includes spaces for community‑oriented programming such as live music and farmers’ markets, making it not just a food court, but a gathering space.

5 Soul Food Co. is well-positioned to meet the appetites of the area’s growing population. Investors gain exposure to recurring cash flows from tenant leases, food hall revenue sharing, and ownership of multiple bar operations, while also benefiting from property appreciation and an eventual exit strategy.

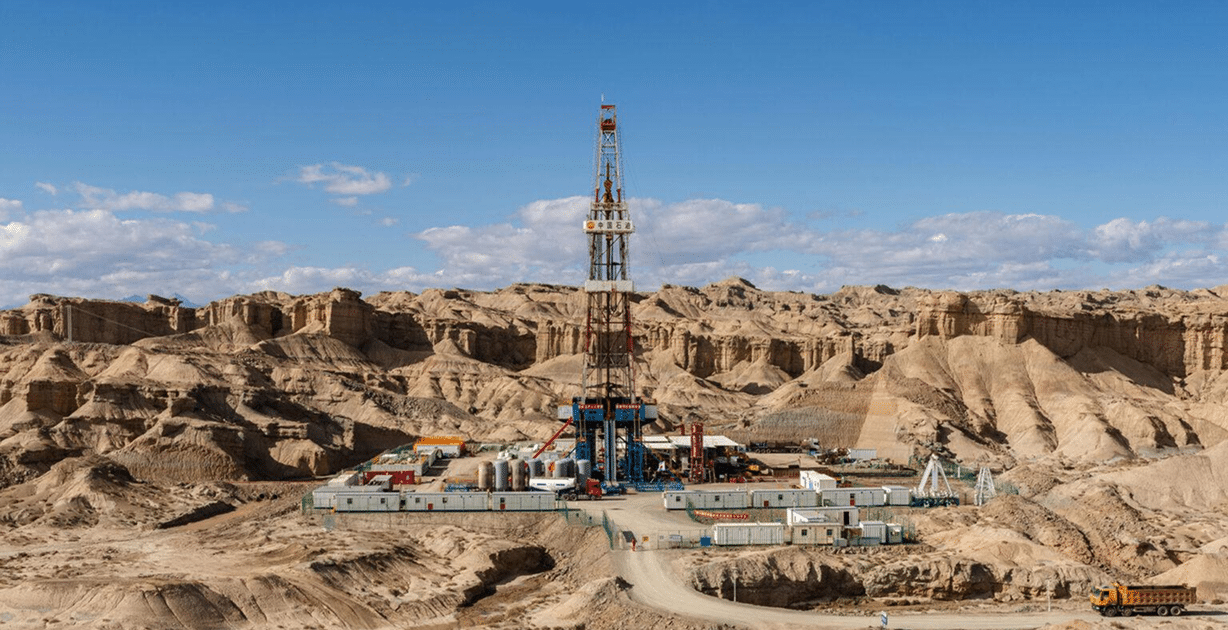

OIL & GAS

Past Oklahoma Oil & Gas Wells – Building a Footprint in the STACK & SCOOP

Quick Facts

- Built a substantial footprint across Oklahoma’s most productive oil and gas regions via partnering with major operators, including Conoco Phillips, Marathon Oil, Continental Resources, and Devon Energy, spanning Kingfisher, Custer, Canadian, Garvin, Caddo, Grady, and Stephens counties in the prolific STACK and SCOOP.

- Implemented a multi-well pad strategy in the mid-2010s in collaboration with our partner operators who developed the strategy, leveraging geological data and optimized completion techniques to maximize recovery, reduce capital costs, and enhance returns from each spacing unit.

- The five top-producing wells located in Grady County’s over-pressured Meramec shale demonstrate a disciplined strategy of focusing on proven areas with consistent, prolific production even in lower commodity price environments.

- Attractive tax benefits and portfolio diversification offer investors up to 90% intangible drilling and completion cost deductions in year one, 15% tax-free gross production income, and low correlation with traditional stock market investments for inflation protection and portfolio diversification.

During the 2015 oil-price downturn, TBV recognized an opportunity to participate in Oklahoma’s prolific STACK and SCOOP plays. TBV participates in several wells throughout the state, with the top-producing wells located within Grady County, known for its over‑pressured Meramec shale. We partnered with Marathon Oil and Continental Resources, focusing on developmental drilling rather than exploratory projects.

This disciplined strategy produced standout wells. For example, the KEM Ranch 1‑24‑25XH horizontal well achieved a 24‑hour rate of 723 barrels of oil per day and 13,989 MCF of gas, ultimately yielding more than 254,000 barrels of oil and over 6.5 million MCF of gas by early 2021. The Anita Fowler 1‑27X26 well recorded peak output of 445 barrels of oil per day and 18,555 MCF of gas; by mid‑2022, it had produced 139,009 barrels of oil and 1.946 billion cubic feet of gas.

Subsequent infill wells, Hale 1 and Hale 2, delivered even higher initial flow rates, underscoring the success of TBV’s strategy of dripping multiple wells from a single pad.

These wells have provided consistent monthly cash flow to investors and set the stage for additional multi‑well pads. From a tax perspective, investors have seen first-year write-offs up to 90 percent due to intangible drilling and completion costs, which can typically be deducted in the first year, and 15 percent of gross production is exempt from income tax. Such energy investments also offer portfolio diversification and an inflation hedge, while partnering with experienced operators can mitigate certain operational risks.

.03

Investments Across Industries

Oil & Gas

Our oil and gas investments speak to our success. Here at TBV, we have aligned our investors with some of the best publicly traded companies in the country. We don’t waste time and money drilling low-quality wells. Instead, we align our partners with publicly traded companies to invest directly in wells at the ground level so they can reap the same benefits that the publicly traded operators do.

Healthcare

By creating opportunities for healthcare investing, we are creating investments that make a difference in the lives of many. Our first healthcare investment opportunity has been proven to be a resounding success. New Waters Recovery is a high-end detox facility in North Carolina that helps clients struggling with substance use disorders. Our next healthcare investment opportunity expands upon the success of the New Waters detox facility as we create a residential treatment center to help clients continue through their recovery journey.

Hospitality

Our mission is to deliver refreshing new dining and entertainment venues to

markets that are severely lacking in dining and delivery options. Our current hospitality investment opportunity, 5 Soul Food Co., will include 8 to 10 independent kitchens offering patrons opportunities to enjoy a different dining option every day of the week, as well as 2 sit-down restaurants, multiple high-end bars, including a rooftop event venue with 360-degree views of the beautiful Texas Hill Country and Lake Travis.

If you would like more details on our track record, you can request it by contacting us today.

Learn More About Thoroughbred Ventures

Disclaimer: These projects speak to TBV’s overall success. Past performance is not a guarantee of future profitability. Your decision to invest should not be based on these metrics alone. All of our ventures are speculative by nature and carry some level of financial risk. Please review all terms and disclosures before investing in any venture.