Meaningful Healthcare Investment Opportunities

Make An Impact and Save Lives With Essential Healthcare Investments

Make An Impact and Save Lives With Essential Healthcare Investments

Advance The Essential Healthcare Industry and Diversify Your Investment Portfolio

TBV Healthcare is a North Texas-based company that builds capital for partner companies, focusing exclusively on building the network necessary to meet the overwhelming and growing demand for resources in the addiction treatment subsector of the behavioral health industry.

We want to be part of the solution our communities need by bringing exciting and vetted investment opportunities in the healthcare sector to the table.

Make an impact while you build your legacy and get excited about where you invest your money.

Current Investment Opportunities in Healthcare

There is a significant shortage of high-end residential addiction treatment facilities within North Carolina. This exciting investment opportunity addresses this need by partnering with the esteemed New Waters Recovery, which currently operates a highly regarded detox facility in Raleigh, NC. Clients currently turn to New Waters to complete the crucial first steps toward freedom from drug and alcohol addiction, and will now be able to continue their treatment journey within the same system.

There is a significant shortage of high-end residential addiction treatment facilities within North Carolina. This exciting investment opportunity addresses this need by partnering with the esteemed New Waters Recovery, which currently operates a highly regarded detox facility in Raleigh, NC. Clients currently turn to New Waters to complete the crucial first steps toward freedom from drug and alcohol addiction, and will now be able to continue their treatment journey within the same system.

New Waters Recovery North Carolina Residential Treatment Center Fund

Following detox, clients usually progress into residential treatment followed by outpatient care. The New Waters Recovery RTC fund will establish both a voluntary, adult‑only residential treatment center and an outpatient clinic in Raleigh that will provide supportive services, psychiatric evaluations, medication management, and individual, group, and family therapy. Comprehensive addiction treatment includes several levels of care, and through the completion of the new residential and outpatient facilities, we will have created a cohesive recovery healthcare system covering all facets of addiction care. By expanding the offerings already provided by New Waters Recovery, we are creating a seamless treatment experience, allowing clients to remain in the same system as they progress toward a future free from addiction.

The existing detox facility, located 35 minutes away from the new residential treatment center, will act as a feeder, with the residential facility capturing the business currently being sent to competitors. By investing in the New Waters Recovery North Carolina RTC Fund, you are piggybacking on the hard work, brand creation, and profitability already achieved by the existing detox facility.

As an investment opportunity, New Waters Recovery North Carolina RTC Fund has the potential to generate a multi-million dollar annual net revenue. Investors participating in this fund would share in the revenues generated as well as the sale proceeds at exit. This is a singular opportunity to invest in something driven by a worthy cause and created to make a difference in the lives of others.

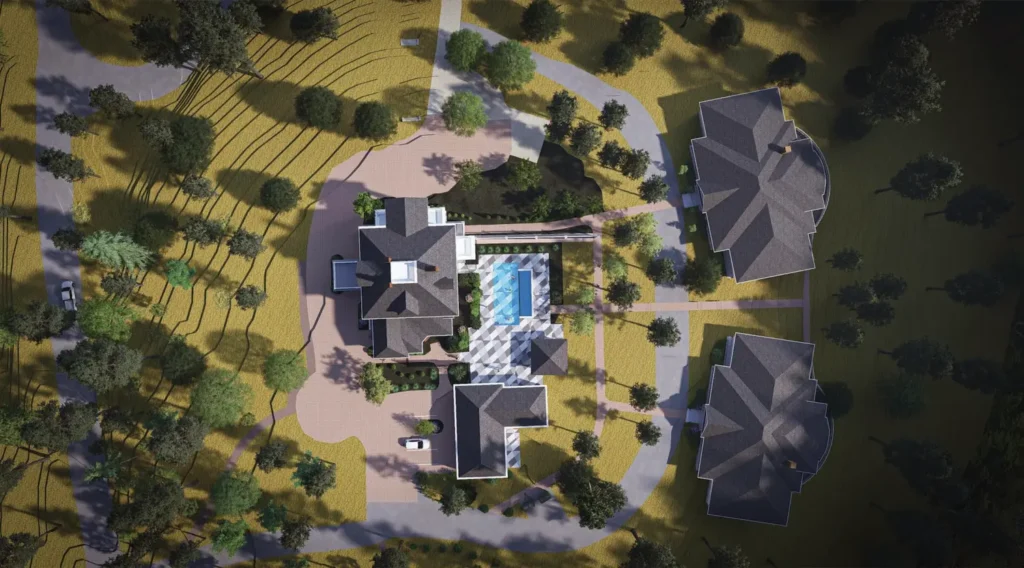

Luxury Residential Addiction Treatment in a Historic Setting

The new treatment center will be located on a 14-acre wooded lot that features a beautifully restored historic home. Additionally, two single‑story residential halls, one for men and one for women, will be built east of the house and include twelve residential spaces each, where clients are expected to stay for 30 to 90 days.

Amenities at the location will include a pool, outdoor living space, full kitchen, a gym, and unique therapy offerings such as massage, IV therapy, and redlight therapy. Physical activity is proven to aid in mental health and well-being, so residents will also have access to water activities, walking trails, yoga, and more.[1]

Safety and comfort are paramount: the site will have a gated entrance, 24‑hour video surveillance, round‑the‑clock staff and nighttime security, a mandatory curfew, and strict prohibitions on weapons, drugs of abuse, and alcohol.

New Waters will pursue North Carolina licensure as a residential facility and Joint Commission accreditation, mirroring the accreditation and licensure of its current detox facility.

TBV Healthcare investors have a unique opportunity to participate in the launch of this new facility and help close a critical gap between detox and long‑term recovery in the region.

Past Investment Opportunity – New Waters Recovery Detox

Serving Raleigh, North Carolina: New Waters Recovery! A boutique substance use disorder detox facility in Raleigh, N.C., with no competitor with the same level of quality. This location has been curated to provide cutting-edge, evidence-based detox and treatment with the highest levels of comfort for those who need it most. We’re not only changing lives, we’re saving them too.

By crafting exceptional quality and personalized treatment experiences for clients seeking relief from mental health disorders and addiction, New Waters Recovery Facilities are setting a new bar for levels of care, comfort, and service in the industry.

Serving Raleigh, North Carolina: New Waters Recovery! A boutique substance use disorder detox facility in Raleigh, N.C., with no competitor with the same level of quality. This location has been curated to provide cutting-edge, evidence-based detox and treatment with the highest levels of comfort for those who need it most. We’re not only changing lives, we’re saving them too.

By crafting exceptional quality and personalized treatment experiences for clients seeking relief from mental health disorders and addiction, New Waters Recovery Facilities are setting a new bar for levels of care, comfort, and service in the industry.

The New Waters Recovery Executive Team

The multidisciplinary team at New Waters Recovery Detox consists of medical and behavioral health experts with extensive experience in addiction care.

Why invest with TBV Healthcare?

In North Carolina, in 2022, there were 4,339 drug overdose deaths.[4] This metric includes deaths from all types of drugs and medications. However, of these deaths, opioids contributed to the majority of deaths.

Historically, opioid-related overdose deaths involving pain medications such as hydrocodone and oxycodone have been the leading cause of overdose deaths, but more recently, illicit opioids such as fentanyl are contributing more significantly to the total. 78.9% of the total overdose deaths in North Carolina in 2022 involved illicit opioids such as fentanyl, while 12.9% of the overdose deaths involved legal opioids dispensed originally for medical purposes.[5] This significant increase in illegal opioid overdoses shows how dangerous these drugs have become to our communities and the increasing need for quality substance abuse treatment options.

From an investor’s perspective, we consider this sector a service to our communities and a positive investment. We’re proud to be offering vital services while also building a legacy of our own. By investing in healthcare with TBV, and more specifically, by investing in addiction and mental health services, you are helping people leave the harmful behaviors associated with drug use behind as they move toward a sober and fulfilling future.

What Types of Healthcare Investment Opportunities Are Worthwhile?

The healthcare sector is diverse, with a wide array of options and niches, from weight loss, wellness, and cosmetic procedure centers to recovery medicine, therapeutics, and private practice. There will always be demographic trends that indicate what type of healthcare investment will be the best for any specific location. However, some of the standout successes in the industry and our experience have been detox and recovery healthcare services.

We may be involved in one or more types of healthcare investment opportunities at any given time and are always eager to pursue new prospects.

How Does Healthcare Investment Work?

Due to the complex regulatory compliance requirements that must be met, a healthcare facility is a complex investment strategy. Research and development costs, clinical trials, health insurance underwriting, supply chain logistics, facility construction, equipment innovations, and more may all be involved before the facility even opens.

In order to project positive future results and financial returns, every project must be meticulously researched, conceptualized, planned, and executed by a team of experts. Working with an experienced team is the best way to mitigate risk, reduce costs and expenses, find the highest quality personnel, and protect against market volatility.

That’s where Thoroughbred Ventures comes in. Before we bring a healthcare investment opportunity to the table, all the due diligence and legwork have already been done, and the results speak for themselves.

Revenue Paths for Healthcare Investment Opportunities

The revenue paths available for each healthcare business will vary depending on the services offered.

Healthcare facilities like those involved in recovery medicine are often considered both real estate development investments and operating businesses. Investors receive cash flow from service fees based on the revenue generated and share in any equity at exit when the entity is sold.

The Benefits of Healthcare Investments

Healthcare is a resilient sector that always manages to not only sustain but also to grow. There aren’t many high‑dollar markets like this that serve all people regardless of economic standing. As such, investments in the healthcare industry offer long‑term growth potential and meaningful additions to any investment portfolio.

They also provide opportunities to participate in medical and biotechnology advancements that support community well‑being and meet the strong demand for services.

The potential for a return on your investment abounds with portfolio diversification in the healthcare sector.

Frequently Asked Questions About Healthcare Investment Opportunities

What are the risks of investing in healthcare stocks versus community‑focused projects?

Healthcare stocks can be lucrative but offer no control over your investment. You simply have to ride the wave, come what may (ineffective drugs, leadership failures, loss of a patient, prescription count volatility, etc.), which means a greater risk to you without any way to influence the outcome.

With a community-focused healthcare project, you get to be on the ground floor of something meaningful and exciting. Your investment makes a direct impact on lives, families, and communities.

How can I invest in the healthcare sector?

Investing in the healthcare sector can take several different forms, from investing in a small business or private practice to owning shares in a large-scale facility or buying healthcare stocks. The best investment for you depends on your overall investment goals and what aligns best with your existing portfolio.

What are the sub‑sectors within healthcare?

There are many niches and sub-sectors in the healthcare space, including pharmaceuticals, medical devices, telehealth, health insurance, hospitals, mental health, nursing homes and care facilities, detox and recovery medicine, boutique wellness clinics, cosmetic procedure clinics, occupational medicine, and more.

- [1] Mahindru, A., Patil, P., & Agrawal, V. (2023). Role of Physical Activity on Mental Health and Well-Being: A Review. Cureus, 15(1), e33475. https://doi.org/10.7759/cureus.33475

- [2] Detox & Medication: Do the odds of completing & staying in treatment get better or worse with repeated attempts? (2025, January 22). Recovery Research Institute. https://www.recoveryanswers.org/research-post/detox-medication-do-the-odds-of-completing-staying-in-treatment-get-better-or-worse-with-repeated-attempts/

- [3] Degenhardt, L., Bucello, C., Mathers, B., Briegleb, C., Ali, H., Hickman, M., & McLaren, J. (2010). Mortality among regular or dependent users of heroin and other opioids: a systematic review and meta-analysis of cohort studies. Addiction, 106(1), 32–51. https://doi.org/10.1111/j.1360-0443.2010.03140.x

- [4, 5] Opioid and Substance Use Action Plan Data Dashboard | NCDHHS. (n.d.). https://www.ncdhhs.gov/opioid-and-substance-use-action-plan-data-dashboard

Partner With TBV on Exciting Healthcare Investment Opportunities

At Thoroughbred Ventures, we’re committed to bringing our accredited investors dynamic and multifaceted investment opportunities. With our concierge-style investment management services and full-transparency asset management, we aim to build strong partnerships that last a lifetime. We want to help you change lives and make a meaningful impact while you simultaneously diversify your portfolio and build your legacy.

Every healthcare development project we set into motion has been meticulously researched and vetted against our highly detailed market analytics before it is ever presented as an investment opportunity. We take every possible precaution to mitigate financial risks and maximize profit returns—for you, for us, and for all of our investment partners. We’d love to connect with you and discuss your next investment! Reach out to the TBV team today to learn more about current and developing opportunities.

Additional Resources

Learn More About Thoroughbred Ventures

Disclaimer: No information provided here should be construed as a guarantee of profit or an offer to invest. There is always risk associated with prospecting and investing, and they represent some level of liquidity risk. Nor should this content be deemed tax advice or legal counsel. TBV works only with accredited investors, and those who meet the requirements should consult with personal or financial consultants before investing.